By Jaime Silveira

BRE #01706045

If you are a real estate fan, you likely know many of the terms used in the “biz.” More than likely though, your day-to-day activities don’t involve a property-for-sale sign or real estate contracts and terms. Until, of course, you need to make a real estate move. If you take some time to acquaint yourself with the more common terms, having a conversation with your Realtor will be more understandable. Rest assured however, your professional Realtor will fill you in on the terms you aren’t familiar with or are needed for your specific transaction.

Of the extensive list of Real Estate Terms found on the California Association of Realtors® website, car.org/en/marketing/clients/realestateterms, here are the more common terms:

- Appraisal/Appraised Value: An opinion of the market value of a home expressed by a real estate appraiser.

- Assessment: A local tax levied against a property for a specific community purpose, such as a sewer or streetlights.

- Bridge Loan: A second trust for which the borrower’s present home is collateral, allowing the proceeds to be usedto close on a new house before the present home is sold. Also known as a “swing loan.”

- Buy-down: When the lender and/or the homebuilder subsidize a mortgage by lowering the interest rate during the first few years of the loan. While the payments are initially low, they will increase when the subsidy expires.

- Closing: The meeting at which a home sale is finalized. The buyer signs the mortgage, pays closing costs and receives title to the home. The seller pays closing costs and receives the net proceeds from the home sale.

- Closing Costs: Expenses in addition to the price of the home incurred by buyers and sellers when a home is sold. Common closing costs include escrow fees, title insurance fees, document recording fees and real estate commissions.

- Contingency: A condition that must be fulfilled before a contract is binding.

- Counteroffer: An offer in response to an original offer.

- Credit Report: A report documenting the credit history and current status of a borrower’s credit standing.

- Credit Risk Score: A credit risk score is a statistical summary of the information contained in a consumer’s credit report. The most well-known type of credit risk score is the Fair, Isaac or FICO score. This form of credit scoring is a mathematical summary calculation that assigns numerical values to various pieces of information in the credit report. The overall credit risk score is highly relative in the credit underwriting process for a mortgage loan.

- Earnest Money: The deposit given by a buyer to a seller to show that the buyer is serious about purchasing the home. Earnest money usually is refundable to homebuyers in the event a contingency of the sales contract cannot be met.

- Equity: The difference between a home’s value and the mortgage amount owed on the home.

- Escrow: The holding of documents and money by a neutral third party prior to closing.

- Homeowner’s Warranty: A policy that covers certain repairs (e.g. plumbing or heating) of a newly purchased home for a certain period of time.

- Listing: A property placed on the market by a listing agent.

- Market Value: The highest price that a buyer would pay and the lowest price a seller would accept on a property. Market value may be different from the price a property could actually be sold for at a given time.

- REALTOR®: A real estate broker or agent who, as a member of a local association of REALTORS®, a state association of REALTORS® and the NATIONAL ASSOCIATION OF REALTORS® (link to onerealtorplace.com), adheres to high standards of professionalism and a strict code of ethics.

- Sweat Equity: Equity created by a purchaser performing work on a property being purchased.

As mentioned, these terms serve as a foundation to help make your conversations around real estate make a bit more sense. Basics are always good to grasp. The definitions presented are concise but do not capture the amount of expertise required by your real estate team to help your transaction succeed, whether you are buying or selling. Each real estate transaction is different in its own way. With every real estate transaction having its own unique circumstances, select your team carefully, they will be equipped with the right knowledge and expertise to help navigate you through the buying or selling process — they’ve got you!

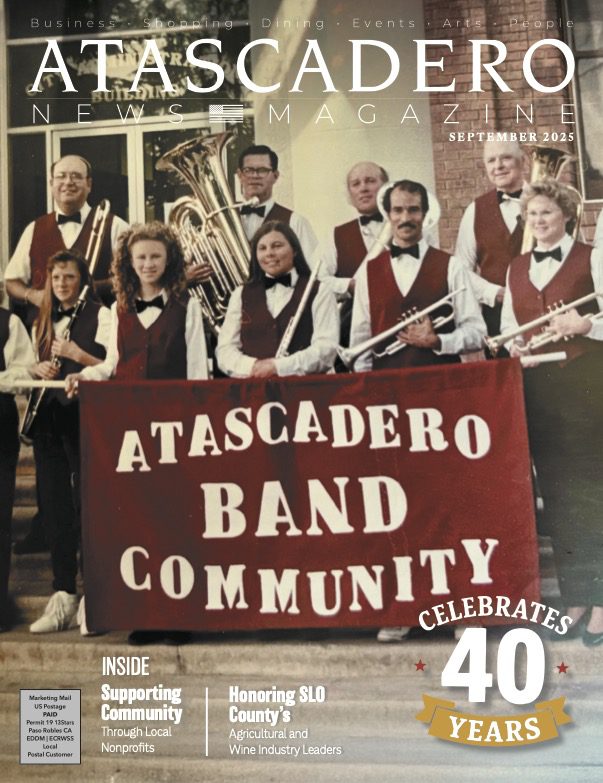

ATASCADERO NEWS MAGAZINE

Copies of Atascadero News Magazine are directly delivered to 11,500 readers in zip codes 93422, 93432, and 93453 and1,500 dropped with support from advertisers and subscribers. Together, we are Making Communities Better Through Print.™

To subscribe or advertise, click here.